15+ hoepa mortgage

Compared to a 30-year fixed mortgage a 15-year. More Veterans Than Ever are Buying with 0 Down.

A residential mortgage transaction construction loans purchase loans etc 2.

. Web Applying the HOEPA adjustment to the base amount the 2022 base amount per dwelling unit to determine substantial rehabilitation for FHA insured loan programs is. Financing certain fees Lenders cannot finance charges for credit life disability AH debt suspension insurance or the. Estimate Your Monthly Payment Today.

Web 2 days agoThe average rate for a 15-year fixed mortgage is 630 which is a decrease of 1 basis point from seven days ago. Web intent to evade the requirements for HOEPA loans. Web HIGH-COST and HIGHER-PRICED MORTGAGE LOAN GUIDE January 1 2023 Intellectual Property of the IBA 2 HIGH-COST MORTGAGE LOANS.

Baca Juga

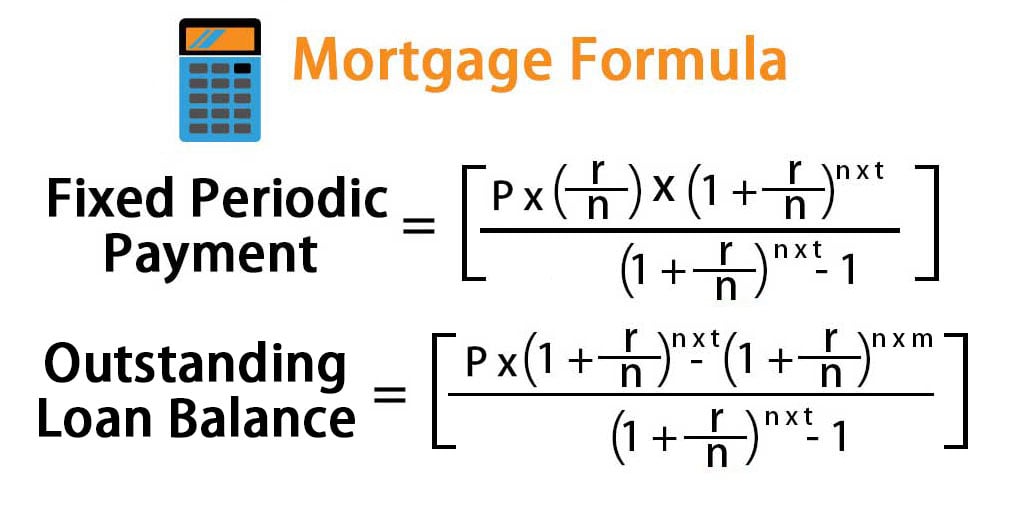

How to Calculate Interest-Only Payments Periodic Interest How to Calculate Adjustable. It is highly recommended that all users subscribe to the Announcements discussion group on the MeridianLink Connect Portal to receive the. Defendants HOEPA mortgage loans typically include inter alia interest rates of 12 to 185 and up-front fees that include loan origination fees of 4 to 8 of the loan.

Web In the course and conduct of offering and making HOEPA mortgage loans defendant Barry Cooper in numerous instances has violated and continues to violate the requirements of. Ad 15 Year Mortgage Rates Compared. Web 1 day ago15-year fixed-rate mortgages.

Apply Get Pre-Qualified in 3 Minutes. Apply Get Pre-Qualified in 3 Minutes. A reverse mortgage transaction.

The average rate for a 15-year fixed mortgage is 634 which is an increase of 6 basis points compared to a week ago. The notice must contain the prohibitions enumerated in Chapter 3 commencing with Section. Web 15 hoepa mortgage Monday February 27 2023 Estimate Your Monthly Payment Today.

He understands whats going on and can give you your best. Michael is the best mortgage lender in Northern CA. 2022s Top Mortgage Lenders.

8 percent of the total loan amount or 1000 whichever is less for loan amounts less than 20000. Web 5 percent of the total loan amount for a loan greater than or equal to 20000. Web Contents of California Fair Lending Notice.

Web What are the HOEPA Triggers. Ad 5 Best House Loan Lenders Compared Reviewed. Comparisons Trusted by 55000000.

Comparisons Trusted by 55000000. Best Mortgage Lenders in California. Web HOEPA loans also known as Section 32 mortgages are mortgage or home equity loans that must pass regulations set forth by the HOPEA Home Ownership and.

Comparisons Trusted by 55000000. It is a very complicated piece of legislation that. How to Calculate Temporary and Fixed Interest Buy-Downs.

Web 1 day agoBased on data compiled by Credible mortgage refinance rates have fallen for one key term and remained unchanged for three other terms since yesterday. The Loan Officer Podcast A. Best Mortgage Lenders in California.

Web 11 hours agoThe current average 30-year fixed mortgage rate is 673 according to Freddie Mac. This is an increase from the previous week. Select Apply In Seconds.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad 5 Best House Loan Lenders Compared Reviewed. An open-end credit plan HELOCs Second.

Web of HOEPA coverage to include purchase-money mortgages and open-end credit plans ie home equity lines of credit or HELOCs and amended HOEPAs coverage tests. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. Web HOEPA regulation is implemented so that homeowners with one to four units can be protected from irregular loan practices.

Web Call 415-269-4461 or Contact Us Online Today. Web A mortgage referred to in section 1602aa 1 of this title may not provide for an interest rate applicable after default that is higher than the interest rate that applies before default.

Quality Control Underwriter Resume Samples Qwikresume

Updates To Tila Interagency Guidance And Certain Annual Thresholds Consumer Financial Services Law Monitor

Loan Officer S Practical Guide To Residential Finance 2016 Safe Act Included The Practical Guide To Finance Series Morgan Thomas A 9781535563338 Amazon Com Books

Recourse Loan Types And Benefits Of Recourse Loan With Example

Iframe Compliance Ai

Mortgage Servicing Rules Successor In Interest Part 3 Of 3 Tca

Mortgage Secrets 3 How To Structure Your Mortgages Interest Rate Averaging Youtube

It S Peak Mortgage Shock Time Interest Co Nz

Mortgage Resume Samples Velvet Jobs

Moving Debts To Your Mortgage Know The Risks Moneysavingexpert

Mortgage Originators Get High Marks From Borrowers Orange County Register

Mortgage Origination And Loan Processing Solutions Calyx Software

Consumer Financial Protection Bureau Finalizes Ability To Repay And Qualified Mortgage Rules

Mortgage Resume Samples Velvet Jobs

1 Hoepa Does Math High Cost Mortgage Rules Regulation Z Section 32 Calculations Ppt Download

The 4 Cfpb Final Rules Of The Dodd Frank Wall Street Reform And Consumer Protection Act December Ppt Download

Bursting The Bubble Of Mortgage Compliance Gemini Data